A Proud Feature in Business View Magazine

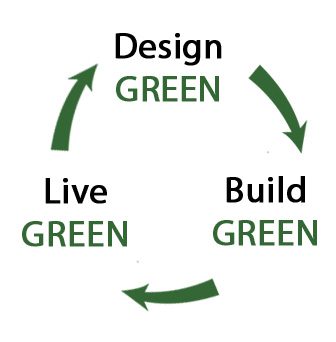

A Proud Feature in Business View Magazine We are thrilled to announce that Living Stone Design + Build has been prominently featured in the latest issue of Business View Magazine. This recognition is a testament to our ongoing commitment to innovation, sustainability, and quality in the custom home building industry. The feature not only highlights our unique approach and outstanding achievements but also aligns perfectly with our enduring values of integrity, craftsmanship, and client-centric service. Being featured in such a renowned publication reflects the hard work of our team and the satisfaction of our clients. Our philosophy emphasizes creating homes that contribute to happier and healthier lives. This philosophy is what sets us apart and reinforces the significance of this recognition. Our journey began decades ago, rooted in the belief that home building should be a blend of artistry and sustainability. Today, our feature in Business View Magazine underscores these principles, showcasing the innovation and dedication that define Living Stone Design + Build. As our President Sean Sullivan outlines in "Building a Quality Custom Home," the process of building extends beyond mere construction—it’s about creating spaces that are not only functional and beautiful but also sustainable and health-affirming. His insights reveal the core of why Living Stone is consistently chosen by those who value quality and excellence. Our Sustainable Practices: Creating Healthier Living Environments The journey to creating sustainable custom homes is not just about using green materials; it's about rethinking the building process. We're proud to design and construct homes that align with environmentally friendly standards. Our sustainable practices were a major highlight in the Business View feature. As noted in the article, "Living Stone Design + Build has consistently led the way in sustainable construction practices." Our homes incorporate innovative green building techniques, which include the use of energy-efficient systems, non-toxic materials, and passive solar design. These features ensure that each home supports a healthier lifestyle while minimizing environmental impact. Client-Centric Design: Building Dreams from Trees to Keys Our client-centric approach has been a cornerstone of our business. We ensure that each project reflects the client’s unique vision, incorporating their needs and desires into every facet of the design. This approach was highlighted in the Business View article: "Clients of Living Stone not only receive a high-quality custom home but also a partner in the design process." We provide a comprehensive service package, guiding clients from lot selection all the way to the final touches—furnishing and beyond. Learn more about our unique "trees to keys" approach and the seamless integration of design and build services here. Notable Achievements: Awards and Recognition Our dedication to excellence has not gone unnoticed. Living Stone has garnered numerous awards, including the national NAHB Green Builder of the Year. Our projects resonate with beauty and functionality, winning accolades for design detail, safety programs, and more.. In Sean Sullivan’s words from his book, "The pursuit of excellence should always be a journey, not a destination." At Living Stone, this journey involves continuous improvement, ensuring our clients experience the best there is in home building. Embracing Community and Craftsmanship Living Stone’s feature showcases our commitment not only to building stunning homes but also to fostering community engagement. "Community building is as integral to our mission as the homes we design," explains Sullivan. Our efforts extend beyond construction to include philanthropic endeavors and community support. Conclusion: Looking Forward We are incredibly grateful for the recognition from Business View Magazine. It is a wonderful validation of our efforts and dedication to our craft. We thank our clients, partners, and team for their continuous support and trust. To everyone interested in creating a truly unique custom home, we welcome you to reach out and start the journey with us. For the full feature, be sure to visit Business View Magazine. Connect with us on social media or sign up for our newsletter to stay in touch with all things Living Stone. Thank you for being a part of our story. Here’s to building a future that's sustainable, beautiful, and always forward-thinking.

Celebrating Our Feature in Custom Builder Online

Celebrating Our Feature in Custom Builder Online We are delighted to share that Living Stone Design + Build has been featured in a noteworthy article on Custom Builder Online. This piece highlights our unique approach and dedication to excellence in custom home building, an achievement that underscores our mission to craft homes that reflect individuality, sustainability, and superior craftsmanship. A Legacy of Innovation and Dedication The article articulates the inspiring journey of Sean Sullivan, our founder, whose vision has propelled Living Stone into the forefront of the custom building industry. With nearly three decades of experience, Sean’s leadership embodies a commitment to creating spaces that resonate with personal significance and environmental responsibility. Advancing the Design-Build Process The article delves into how Living Stone has revolutionized the industry through the design-build process. This approach integrates design and construction from day one, streamlining communications and enhancing project outcomes. "True innovation in homebuilding comes from collaboration and the seamless integration of design and construction," Sean emphasizes in his book Building a Quality Custom Home, encapsulating our dedication to crafting homes that perfectly align with our clients’ visions while maintaining excellence. Leaders in Green Building Our unwavering commitment to sustainability is another highlight of the article. Living Stone has long prioritized green building practices, ensuring every home meets rigorous environmental standards. Sean captures this ethos in his book by stating, "A well-built home not only conserves resources but also nurtures the health and well-being of its inhabitants." This principle is at the heart of our projects, as we strive to create healthy homes that benefit both our clients and the environment. Unparalleled Client Experience Central to Living Stone’s approach is our Eight Levels of Service, a client-centered strategy designed to enhance the custom home building journey. This comprehensive framework ensures that we meet and exceed client expectations, as highlighted in the article. From design to construction, our services are tailored to each client’s unique needs. Sean notes, “Building a home should be a rewarding journey, marked by clear communication and mutual respect," a mindset that drives us to deliver not only exceptional homes but also exceptional experiences. A Bright Future Ahead This feature in Custom Builder Online is a testament to the passion and perseverance that defines Living Stone Design + Build. We invite you to explore the full article on Custom Builder Online to gain deeper insight into our philosophy and accomplishments. We extend our gratitude to our clients, partners, and dedicated team for their trust and support. We look forward to continuing our journey of building exceptional homes that reflect our clients’ dreams and values. Let’s continue to create meaningful spaces that inspire and endure.

Help Wanted: Carpenter at Living Stone Design + Build

Overview: Living Stone Design + Build is seeking an experienced carpenter to join our team specializing in new construction. We need someone who thinks creatively and possesses their own truck and tools. Candidates must be willing to travel within a 60-mile radius. While most work is on-site, some tasks may occasionally require off-site completion. We provide opportunities for performance-based advancement in a fast-paced, team-oriented environment focused on customer satisfaction. If this sounds like a good fit, please apply online here. Minimum Qualifications: 5+ years of experience in rough or finish carpentry Proficient in using power tools such as skill saws, chop saws, and jigsaws Skilled in utilizing chisels, planes, saws, drills, and sanders for repairs and construction Own basic hand tools and reliable transportation to job sites Ability to join materials using nails, screws, staples, or adhesives with precision Comfortable working on stilts, ladders, scaffolding, and high beams Capable of lifting/carrying at least 100 lbs Knowledge of lumber grades and wood species; skilled in selecting raw materials Ability to estimate height, width, length, and other proportions Experienced in creating structures for concrete pouring Team-oriented with a focus on achieving goals Key Responsibilities: Prepare project layouts Arrive at work prepared, coordinating material pick-up in advance Work from building plans or supervisor instructions to meet project specifications Ensure work meets code and quality standards, collaborating with project managers on inspections Measure, cut, and shape materials Construct building frameworks, including walls, floors, and doorframes Assist in erecting and leveling building frameworks using rigging hardware and cranes Inspect and replace damaged structures to maintain high quality Willing to work overtime as needed to meet project deadlines Conduct quality control of work performed Utilize tools effectively to repair and construct structures Ensure job sites are clean and organized Instruct and guide laborers and other tradespeople Maintain professionalism and respect in all interactions Focus on quality, productivity, and safety Adapt to changes and manage competing demands Be punctual and dependable Take initiative and seek opportunities for growth Additional Qualifications: Ability to travel to assigned job sites Education/Experience: Minimum of five years of verifiable experience in new construction and building Ability to read and interpret framing drawings, elevations, and safety regulations Language Skills: Proficient in reading safety rules, operating instructions, and procedural manuals Mathematical Skills: Competent in measurements, angles, proportions, and basic algebra and geometry Reasoning Ability: Able to solve practical problems and interpret various instructions Physical Demands: Work at construction sites both indoors and outdoors Ability to perform tasks that require standing, walking, climbing, and manual dexterity Overtime may be necessary to meet project timelines Work Environment: Regular exposure to wet conditions, moving parts, and varying weather Occasional exposure to hazardous materials and loud noise Job Type: Full-time Pay: $18.00 - $25.00 per hour Benefits: 401(k) with matching Health insurance Paid time off Vision insurance Life insurance Schedule: 8-hour shifts License/Certification: Driver's License (Preferred) Location: Multiple locations available. Apply online here. Contact: jennifer@livingstoneconstruction.com or call 855.720.2435

Best Builders in Upstate South Carolina

[et_pb_section fb_built="1" admin_label="section" _builder_version="4.16" custom_padding="76px||21px|||" da_disable_devices="off|off|off" locked="off" global_colors_info="{}" da_is_popup="off" da_exit_intent="off" da_has_close="on" da_alt_close="off" da_dark_close="off" da_not_modal="on" da_is_singular="off" da_with_loader="off" da_has_shadow="on"][et_pb_row admin_label="row" _builder_version="4.16" background_size="initial" background_position="top_left" background_repeat="repeat" custom_padding="||13px|||" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.16" custom_padding="|||" global_colors_info="{}" custom_padding__hover="|||"][et_pb_text admin_label="Title" module_class="chronospro-heading green-heading" _builder_version="4.27.0" header_text_align="left" header_2_text_align="left" header_2_text_color="#727272" module_alignment="left" custom_margin="||||false|false" border_style="solid" locked="off" global_colors_info="{}"]Best Builders in Upstate South Carolina When it comes to building your dream home in Upstate South Carolina, choosing the right builder is crucial. The region boasts a wealth of talented and experienced custom home builders, each bringing their unique expertise and approach to the table. In this comprehensive guide, we'll explore some of the best builders in the area, highlighting what makes them stand out and why they might be the perfect fit for your project.[/et_pb_text][et_pb_image src="https://media-upload-livingstone.s3.amazonaws.com/img/20240910032939/3.webp" alt="Luxury Custom Home Builder in Asheville" title_text="Luxury Custom Home Builder in Asheville" _builder_version="4.27.0" _module_preset="default" custom_margin="20px||11px|||" global_colors_info="{}"][/et_pb_image][/et_pb_column][/et_pb_row][et_pb_row module_id="moss" _builder_version="4.27.0" _module_preset="default" custom_padding="5px||2px|||" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.27.0" _module_preset="default" global_colors_info="{}"][et_pb_text admin_label="Text" module_class="chronospro-heading green-heading" _builder_version="4.27.0" header_text_align="left" header_2_text_align="left" header_2_text_color="#727272" module_alignment="left" custom_margin="29px||||false|false" border_style="solid" locked="off" global_colors_info="{}"]Choosing the right builder is a crucial step in the process of building a custom home. We have another blog post dedicated to this topic, which is well worth your time. In it, you’ll find indispensable advice and red flags to look out for when choosing a builder, as well as a printable list of questions that you can ask your top choices. Read: Choosing the Right Builder From innovative design-build firms to traditional custom home builders, Upstate South Carolina offers a diverse range of options for those looking to create their ideal living space. These top-tier builders have earned their reputations through a combination of craftsmanship, customer service, and a deep understanding of the local landscape and lifestyle. Whether you're planning a cozy mountain retreat or a luxurious lakeside estate, these builders have the skills and experience to bring your vision to life.[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version="4.19.1" _module_preset="default" width_tablet="" width_phone="90%" width_last_edited="on|phone" custom_padding="||6px|||" locked="off" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.19.1" _module_preset="default" global_colors_info="{}"][et_pb_text admin_label="Title" _builder_version="4.27.0" _module_preset="default" header_2_font="||on||||||" header_2_text_align="left" header_2_font_size="44px" custom_margin="||17px||false|false" header_2_font_size_tablet="31px" header_2_font_size_phone="31px" header_2_font_size_last_edited="on|tablet" border_width_bottom="2px" border_color_bottom="#919191" locked="off" global_colors_info="{}"]Table of Contents[/et_pb_text][et_pb_button button_url="#living" button_text="Living Stone Design + Build" admin_label="Living Stone Design + Build" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"]Luxury custom homes with a focus on integrity and wellness.[/et_pb_text][et_pb_button button_url="#fairview" button_text="Fairview Custom Homes" admin_label="Fairview Custom Homes" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"]Known for their attention to detail and custom-tailored designs.[/et_pb_text][et_pb_button button_url="#gabriel" button_text="Gabriel Builders" admin_label="Gabriel Builders" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"]Offers a unique approach with long-lasting client relationships and impactful designs.[/et_pb_text][et_pb_button button_url="#dillard" button_text="Dillard-Jones Builder" admin_label="Dillard-Jones Builder" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"]Distinguished by their numerous accolades and recognition in the industry.[/et_pb_text][et_pb_button button_url="#berry" button_text="The Berry Group" admin_label="The Berry Group" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"]Emphasizes a client-focused approach in serving Upstate South Carolina.[/et_pb_text][et_pb_button button_url="#peery" button_text="Peery Homes" admin_label="Peery Homes" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"]Stands out for their client-centered focus and personalized building process.[/et_pb_text][et_pb_button button_url="#ridgeline%20" button_text="Ridgeline Construction Group" admin_label="Ridgeline Construction Group" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"]Specializes in luxury mountain and lake homes with a focus on challenging terrains.[/et_pb_text][et_pb_button button_url="#greenville" button_text="Greenville Custom Builders" admin_label="Greenville Custom Builders" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"] Excels in creating personalized, high-quality homes in the Greenville area.[/et_pb_text][et_pb_button button_url="#goodwin" button_text="Goodwin Foust Custom Homes" admin_label="Goodwin Foust Custom Homes" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"]Known for bringing clients' visions to life with unique, customized designs.[/et_pb_text][et_pb_button button_url="#rembrey" button_text="Rembrey Custom Homes" admin_label="Rembrey Custom Homes" _builder_version="4.27.0" _module_preset="default" custom_button="on" button_text_size="23px" button_text_color="#4d5357" button_border_width="0px" button_font="|700|||||||" button_icon="7||divi||400" button_on_hover="off" custom_margin="||6px|||" custom_padding="||3px|||" global_colors_info="{}" button_text_color__hover_enabled="on|hover" button_text_color__hover="#58a618"][/et_pb_button][et_pb_text _builder_version="4.27.0" _module_preset="default" custom_padding="|17px||17px|false|true" global_colors_info="{}"]Committed to quality craftsmanship and customization in their builds. [/et_pb_text][et_pb_divider color="#4D5357" _builder_version="4.27.0" _module_preset="default" width="86%" module_alignment="center" custom_margin="||||false|false" custom_padding="20px||9px||false|false" global_colors_info="{}"][/et_pb_divider][/et_pb_column][/et_pb_row][et_pb_row admin_label="Living stone" module_id="living" _builder_version="4.27.0" _module_preset="default" custom_padding="5px||2px|||" collapsed="off" global_colors_info="{}"][et_pb_column type="4_4" _builder_version="4.27.0" _module_preset="default" global_colors_info="{}"][et_pb_image src="https://media-upload-livingstone.s3.amazonaws.com/img/20231129143231/Image-14-1-2.jpg" alt="commercial construction" title_text="commercial construction" _builder_version="4.27.0" _module_preset="default" custom_margin="20px||11px|||" locked="off" global_colors_info="{}"][/et_pb_image][et_pb_text admin_label="Text" module_class="chronospro-heading green-heading" _builder_version="4.27.0" header_text_align="left" header_2_text_align="left" header_2_text_color="#727272" module_alignment="left" custom_margin="29px||||false|false" border_style="solid" locked="off" global_colors_info="{}"]Living Stone Design + Build Expertise and Commitment We know we might sound biased, but we truly believe our homes stand out in this building community for several compelling reasons. We are deeply committed to quality and integrity in every project we undertake. This commitment begins with our choice of construction materials and finishes. Unlike many builders who offer these as upgrades, our baseline standards already include top-tier options. This means every home we build is crafted to last, providing durability and beauty that endure. LeadershipRead More